I am taking a slightly different approach to summing up the top stock picks for this week.

For starters, I will begin to include the criteria I’ve used to feed stocks through my program. For this week, the criteria is:

- Stock listed on Nasdaq / NYSE = True

- Daily Volume and Avg Volume > 150,000

- Intraday price < $250

- Has revenue = True

- Positive EPS = True & Growing YoY

- Positive EBITDA = True

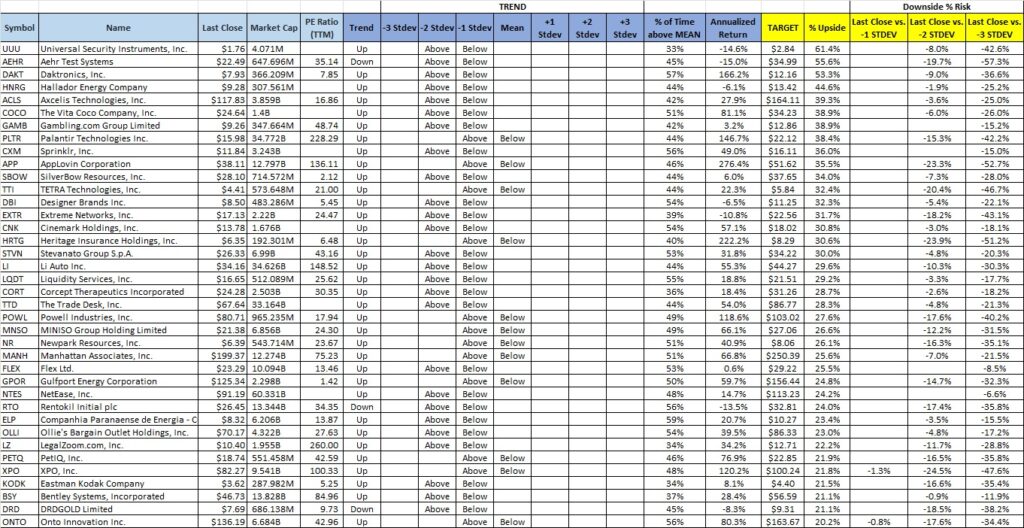

My stock screener has generated the following 38 top stock picks out of 1451 stocks screened. These 38 top stock picks are filtered based on:

- Stocks with a 20% or greater potential return vs. the target price, irrespective of current price vs. stdev

- Stocks with at least 1 full year of trading history

- 10 stocks were removed intentionally due to high levels of risk (higher than the remaining 38 stocks), despite meeting the criteria above

I run my algorithm the same way, but I now short-list the stocks primarily by the % upside potential return to the target price, whereas before I was showing all returns for any stock trading at the lower stdev bounds. I’ve pivoted to this approach to show only stocks with the best potential returns.

I adjust the target price accordingly based on whether the stock is in an Up trend or Down trend. The target becomes more of a stretch if the stock is in an Up trend.

The data set now shows the % of time the stock has spent above the MEAN / Trend Line over the past year. I’ve removed some other columns that I felt make the table “too busy” and the data was not value-add.

There are 7 stocks that have favorable risk/reward ratio and have historically traded at least 50% of the time above the MEAN / Trendline.

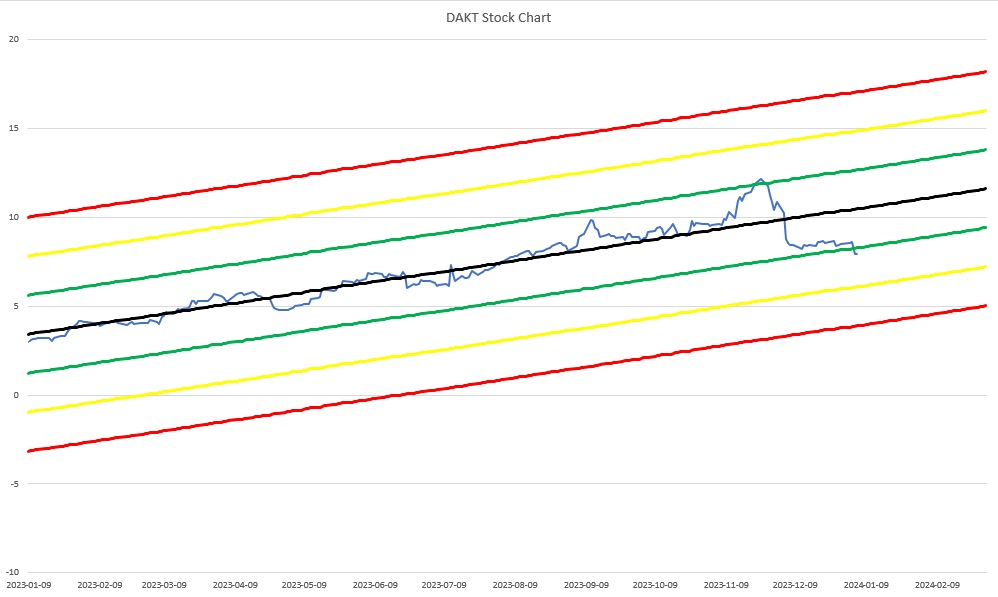

DAKT – Daktronics, Inc.

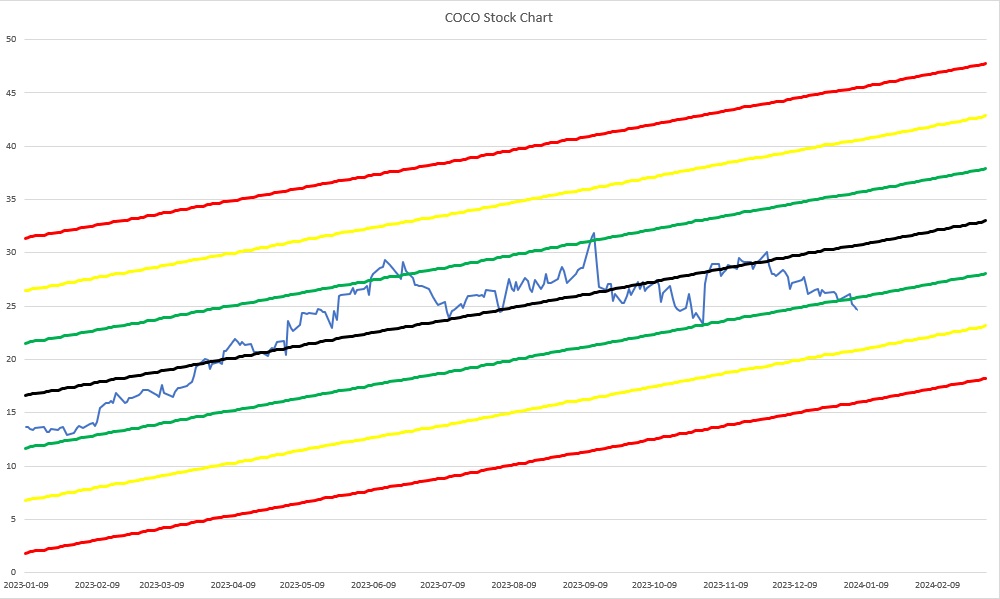

COCO – The Vita Coco Company, Inc.

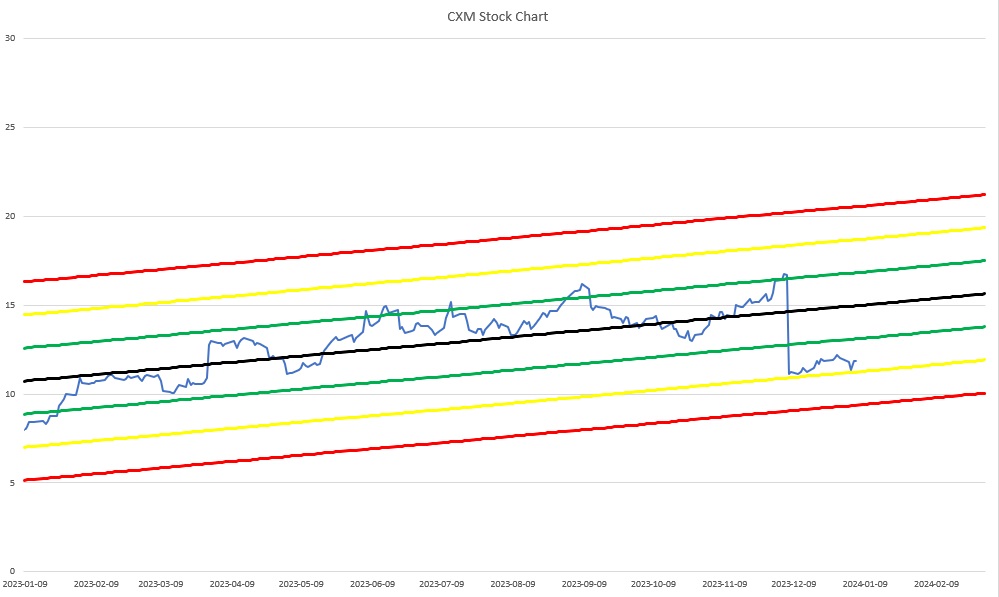

CXM – Sprinklr, Inc.

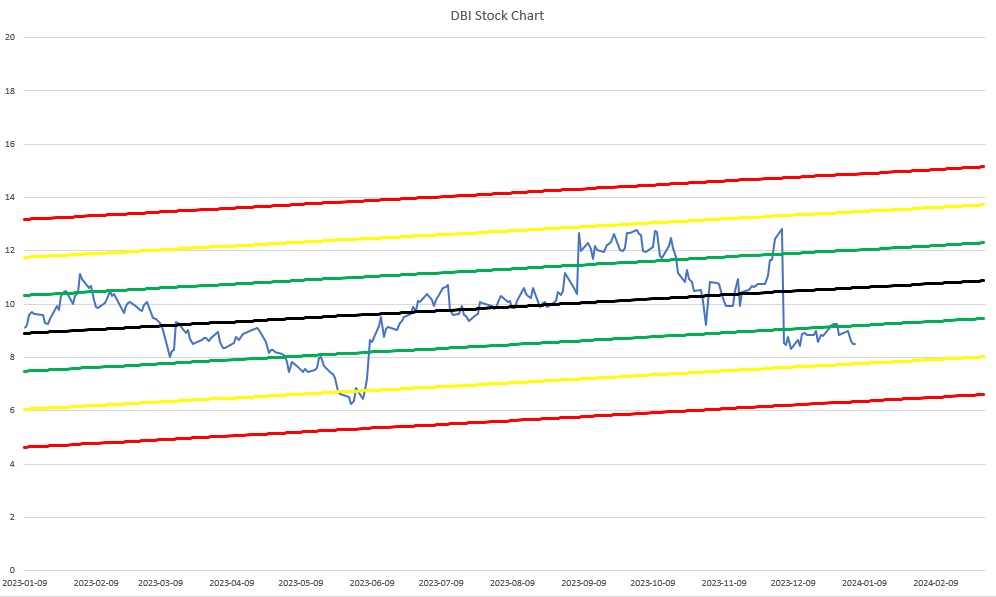

DBI – Designer Brands Inc.

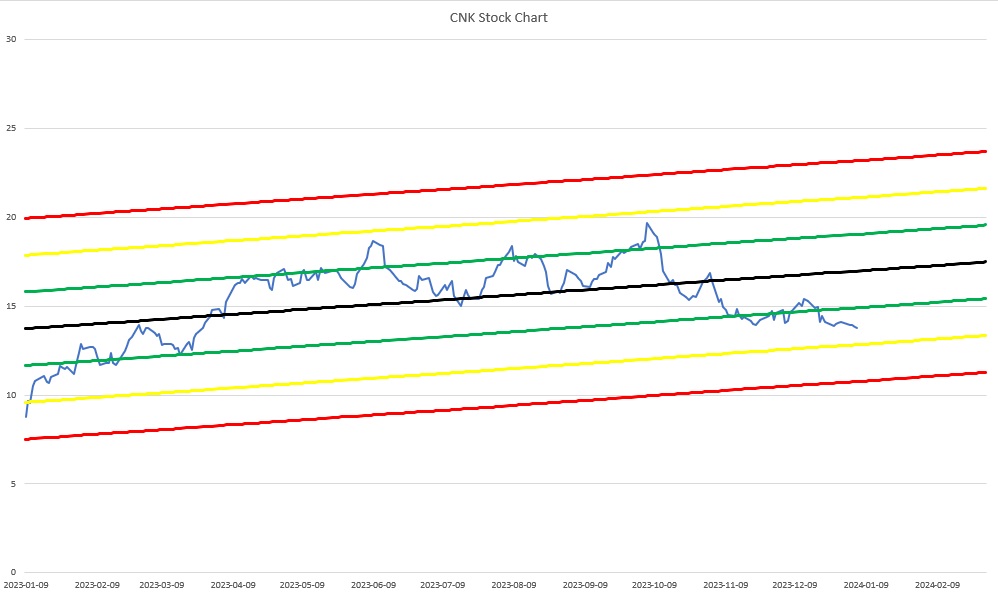

CNK – Cinemark Holdings, Inc.

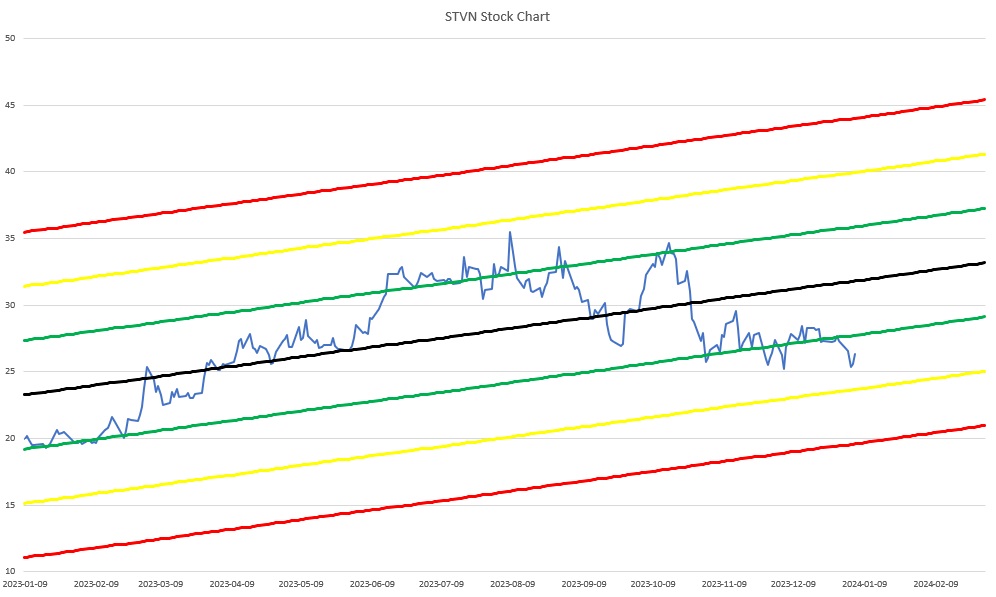

STVN – Stevanato Group S.p.A.

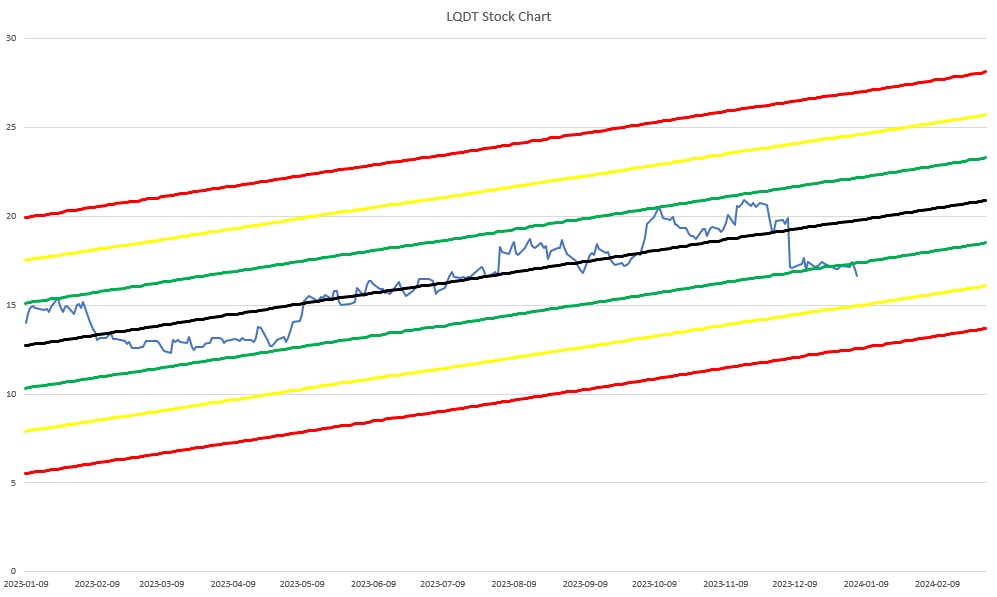

LQDT – Liquidity Services, Inc.