Investment Portfolio Objective:

Manage a real money portfolio of long stock positions that generates returns consistently outperforming the S&P500.

Investment Portfolio Approach:

- Identify stocks that are great candidates to add to the investment portfolio (either immediately or into a watch list with target buy prices)

- Stock candidates are determined by:

- Runing my algorithm weekly scanning all S&P500 stocks

- Running my algorithm on any other stock I come across

- Leveraging statistics and math to determine the target buy prices

- Staying current on market activity daily to assess potential opportunities as companies report earnings, or stocks are making out-sized moves daily up or down

- News / articles with noteworthy mentions of business developments

- Business health, historical performance and projected future growth

- Analyst opinions and forecasts

- Maintaining a cash balance in the investment portfolio to buy stocks the moment they become buying opportunities

- Portfolio positions are monitored closely and are either increased, reduced or sold entirely depending on performance

- Positions are monitored vs. my algorithm price targets and vs. projected growth estimates

- Monitor overall market activity and macro-economic conditions to try and determine hedge strategies to de-risk and offset volatility

Algorithm capabilities:

- Run any ticker on any look-back timeframe to assess historical performance

- Identify whether stocks are in an up or down trend & the slope of the trend

- Measure historical volatility to a +/- 3 st dev

- Measure % of historical closing prices above & below the MEAN

- Set target prices by extending trend lines out +1 YR from the current point in time

- Measure % downside risk

Investment Mindset:

- A portfolio management approach leads all investing decisions with a disciplined asset allocation strategy.

- There will never be any celebration of a single position’s success. The portfolio must work together in harmony to generate returns as a collective unit.

- Use time as an advantage by waiting for the right buying opportunities.

- There will always be lucrative positions to initiate. Keeping a strong watch list up to date is critical.

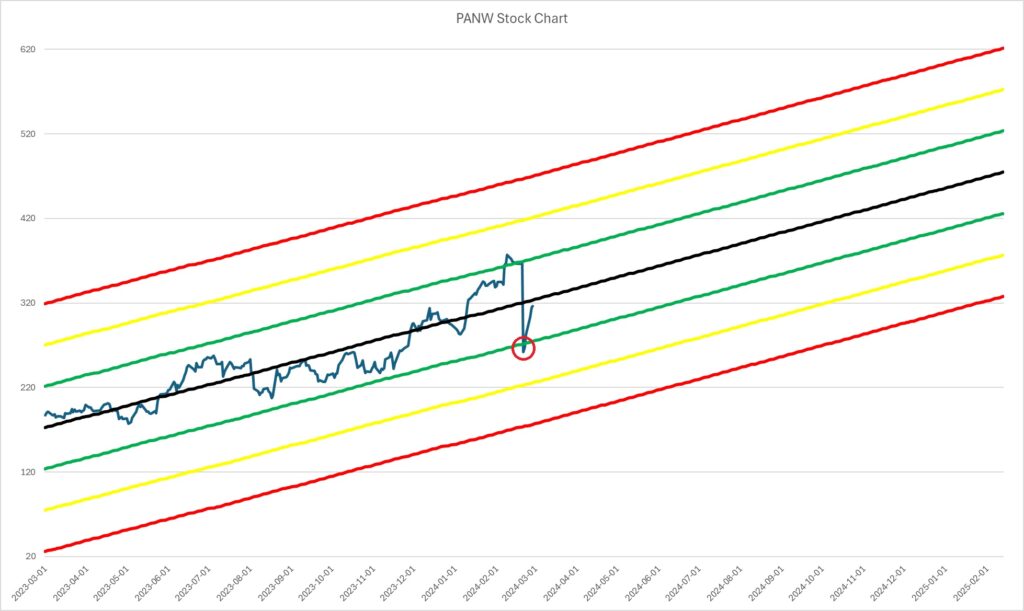

- Act quickly when the opportunities present themselves, below is an example of position that was initiated on PANW (Palo Alto Networks, Inc.) on Feb 22, 2024 following the company’s Q2 2024 earnings release. Prior to this, the stock was on the watch list.